how much is inheritance tax in nc

However state residents should remember to take into account the federal estate tax if. No estate tax or.

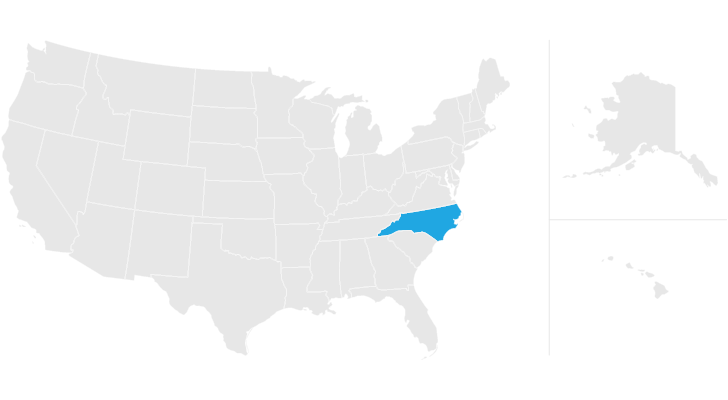

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

It can be less if the court determines to set it lower.

. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. Which states have no estate tax. 5740 million North Carolina.

States With No Income Tax Or Estate Tax The states with this powerful tax combination of no state estate tax and no income tax are. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. The top estate tax rate is 16 percent exemption threshold.

There is no inheritance tax in North Carolina. Elliot Marks Author Social Security Advisor. There is no inheritance tax in NC.

According to the law an executor can receive up to five percent of the value of the estate for compensation. Other forms of retirement income are taxed at the North Carolina flat income tax rate of 525. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance.

5 rows How Much Tax Do You Pay On Inheritance In Nc. These are some of the taxes you may have to think about as an heir. North Carolina does not collect an inheritance tax or an estate tax.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Surviving spouses are always exempt. Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo.

There is no inheritance tax in NC. No estate tax or inheritance tax. A surviving spouse is the only person exempt from paying this tax.

State inheritance tax rates range from 1 up to 16. The top inheritance tax rate is 16 percent no exemption threshold New Mexico. North Carolina does not collect an inheritance tax or an estate tax.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. However this is five percent of the value after all debts have been paid. There is no guarantee of five percent in the law.

North Carolina Inheritance Tax and Gift Tax. Inheritances that fall below these exemption amounts arent subject to the tax. If the tax rate for a 40000 inheritance is 10 then you as the taxpayer would owe 4000 in taxes on that inheritance.

If you inherit property in Kentucky for example that states. All inheritance are exempt in the state of north carolina. In 2021 federal estate tax generally applies to assets over 117 million.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. However there are sometimes taxes for other reasons.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. North Carolina Inheritance Tax and Gift Tax.

No Inheritance Tax in NC. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million. There is no federal inheritance tax but there is a federal estate tax. The major difference between estate tax and inheritance tax is who pays the tax.

A surviving spouse is the only person exempt from paying this tax. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming. The inheritance tax rate in north carolina is 16 percent at the most according to nolo.

No estate tax or inheritance tax. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. Inheritance taxes are levied on heirs after they have received money from the deceased.

An inheritance tax is usually paid by a person inheriting an estate. North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. Bank accounts certificates of deposit and investment.

However there are sometimes taxes for other reasons. No estate tax or inheritance tax.

North Carolina Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

207 N Locust St Black Mountain Nc 28711 Colorado Homes House Black Mountain

Death And Taxes Inheritance And Estate Tax In The Carolinas King Law

Wills Are Often Very Misunderstood And The Relatives Of Those Who Have A Will Expecting The Will Would Keep Family Law Advice Probate Estate Planning Attorney

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

A Guide To North Carolina Inheritance Laws

Federal Gift Tax Vs California Inheritance Tax

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts Teaching Geography

States With No Estate Tax Or Inheritance Tax Plan Where You Die