how to add doordash to taxes

Incentive payments and driver referral payments. Your total business miles are 10000.

This Is The Funniest Shit I Ve Heard From Doordash R Doordash

Youll input this number into your Schedule C to report Gross Earnings on Line 1.

. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. Your 1099 tax form will be available to download via Stripe Express. Please note that DoorDash will typically send.

Otherwise you would need to track every expense related to your car calculate depreciation costs and then claim the. You may also find that you need to purchase other deductible work equipment as well including drink holders or spill-proof covers for your car seats. It may take 2-3 weeks for your tax documents to arrive by mail.

DoorDash will send you tax form 1099-NEC if you earn more than 600. Its really simple to calculate your deduction. You will receive your 1099 form by the end of January.

Youll go ahead and input your total earnings and any deductions you want to take and the software will calculate what youll owe for you. So if you drove 5000 miles for DoorDash your tax deduction would be 2875. You should report your total doordash earnings first.

Keep an eye out for this email and make sure it doesnt go to spam youll. Your 1099 tax form will be mailed to you if you dont receive an email from Stripe or dont consent to e-delivery. 10000 20000 5 or 50.

The forms are filed with the US. DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities. When using the mileage method.

My Account Tools Topic Search Type 1099misc Go Enter your 1099misc and follow the prompts My Account Tools Topic Search Type vehicle expenses. Using tax software like Turbo Tax. Add up all of your income from all sources.

Internal Revenue Service IRS and if required state tax departments. The income as well as expenses including your vehicle can be entered by following the information below. Please allow up to 10 business days for mail delivery.

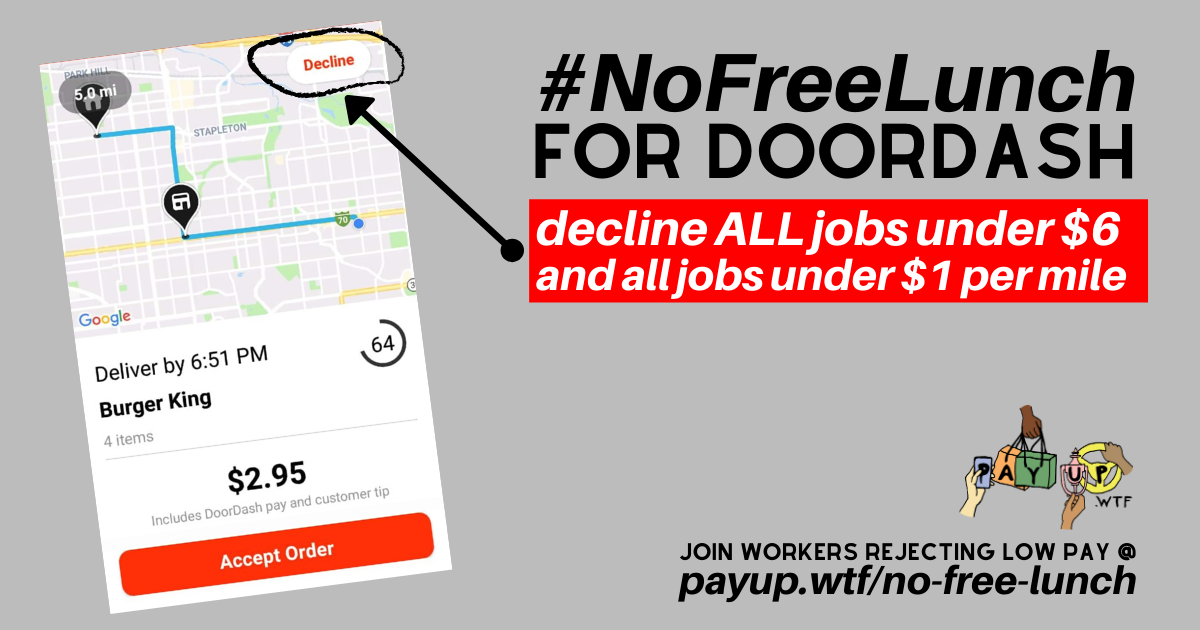

The minimum pay is 200. This includes 153 in self-employment taxes for Social Security and Medicare. You can do this with one of the many.

E-delivery through Stripe Express. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your. You can quickly determine the total number of miles that you drove for work if you use a mileage tracker app like Falcon Expenses.

They dropped that minimum from 300 in August of 2021. Theyve used Payable in the past In early January expect an email inviting you to set up a Stripe Express Account. The DoorDash income Form 1099misc is considered self employment income.

First make sure you are keeping track of your mileage. Its really simple to calculate your deduction. That may not seem like much but in a typical day can save you 28 57 or more depending on how much you drive.

In this video I will break down how you can file your taxes as a doordash driver and also what you can write-off and how you can calculate how much money you. Paper Copy through Mail. Form 1099-NEC reports income you received directly from DoorDash ex.

You will be provided with a 1099-NEC form by Doordash once you start working with them. Doing your own taxes. 5000 x 5 2500 which is the amount you can claim.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Also on the Schedule C youll mark what expenses you want to claim as deductions. This reports your total Doordash earnings last year.

This video explains how to enter my income and expenses from doordash 1099- NEC in TurboTax. To file taxes as a DoorDash driver aka. This means for every mile you drive you pay 057 less in taxes.

The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile for the 2021 tax year and 585 cents in 2022. DoorDash requires all of their drivers to carry an insulated food bag. All you need to do is track your mileage for taxes.

If you live in a state with income taxes youll also need to file a state tax return. DoorDash drivers are expected to file taxes each year like all independent contractors. In 2020 the rate was 575 cents.

DoorDash sends their 1099s through Stripe. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. In practice thats usually only paid on deliveries where more than one order is delivered at a time.

Drivers who make more than 20000 with more than 200 transactions will have to file form 1099-K. Each year tax season kicks off with tax forms that show all the important information from the previous year. All you need to do is track your mileage for taxes.

You should be keeping track of your work-related mileage. There are four major steps to figuring out your income taxes. For 2020 the mileage reimbursement amount is 057.

Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. In 2020 the rate was 575 cents.

As of the original writing of this article May 2022 Doordash has typically paid a minimum of 250 on single orders. Mileage and DoorDash taxes at the end of the year. An independent contractor youll need to fill out the following forms.

How to File DoorDash Taxes. Expect to pay at least a 25 tax rate on your DoorDash income. Your total auto expenses are 5000.

Your total miles are 20000. Tax Forms to Use When Filing DoorDash Taxes. It also includes your income tax rate depending on your tax bracket.

Calculate your income tax and self-employment tax bill. Take note of how many miles you drove for DoorDash the app will tell you and multiply it by the Standard Mileage deduction rate. A simple way to calculate your roadside assistance tax deduction is to take the total number of all miles you drove for the year and determine what percentage of those miles were for work.

You will also know how you can add all the deduction on TurboTax. Box 7 Nonemployee Compensation will be the most important box to fill out on this form. Because this is a necessity for your job you can deduct the cost of buying the bag at tax time.

This method is called the Standard Mileage Deduction. If youre a Dasher youll need this form to file your taxes. Reduce income for income tax purposes by applying deductions.

Apply previous payments and credits to the tax bill and figure out if you.

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

How To Get Doordash Tax 1099 Forms Youtube

Doordash Dasher You Can No Longer See Tip Earnings Youtube

How To File 1099 Taxes Properly Uber Doordash Lyft Etc Youtube

How Do I File Taxes When Partnering With Doordash

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

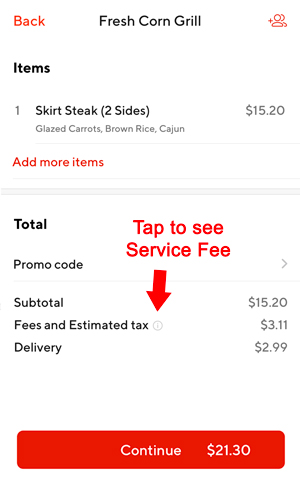

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash Driver Canada Everything You Need To Know To Get Started

Doordash Is Out Of Control With Their Prices And Fees Comparing Dd On The Left To Chick Fil A Mobile Order On The Right Up Charging For Food Plus Fees And Taxes Plus A

I Lost 550 Last Month With Doordash This Everlance Expense App Is Mandatory For Every Delivery Person See What Is Really Going On R Doordash

Doordash Driver Canada Everything You Need To Know To Get Started

This Is Why You Deduct Every Little Thing You Can R Doordash

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Can I Update My Pickup Instructions