reit tax benefits ireland

However the Government would need to change the. Accelerated tax depreciation allowances for approved energy efficient equipment.

Distributions to investors derived from tax-exempt rental profits.

. Again this could reach a. Also they are generally exempt from chargeable gains made on the disposal of assets of their property rental business only. Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property.

In Ireland this requirement is set at 85 of rental profits. The main tax implications of electing for REIT status are. Form DWT Claim Form- REIT refers.

Thus in general a REIT owes no federal income tax if its dividends paid are at least equal to its taxable income. Irish resident corporate investors will be liable to 25 corporate tax on such distributions. Irish resident investors will be liable to capital gains tax at a rate of 33 on a disposal of shares in the REIT.

Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits. Where shares in a REIT are held by an investment undertaking that investment undertaking may be an IREF - TDM Part 27-01b-02 refers. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

To eliminate the double layer of taxation which typically hinders the holding of property through a company a REIT is exempt from corporation tax on qualifying profits from rental property. Get your free copy of The Definitive Guide to Retirement Income. Guidance on the treatment of expenses incurred.

A REIT is exempt from corporation tax on qualifying income and gains from rental property subject to a high profit distribution requirement to shareholders. Financial Benefits of REITs. Investors in the top tax bracket can potentially see their tax bill for dividends go.

Property rental business Property rental business profits and gains are tax-exempt within the REIT itself. REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. They are generally exempt from Corporation Tax CT on income from their property rental business only.

This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. Real Estate Investment Trusts REITs are recognised as important vehicles for property investment in over 30 jurisdictions throughout the world. A Real Estate Investment Trust REIT is a company that directly invests in income-producing real estate either owning or managing the properties themselves.

REITs have historically provided investors dividend-based income competitive market performance transparency liquidity inflation protection and portfolio diversification. Instead the company is required to distribute the vast majority of its profits to. REITs without paying an.

Preferred shares in addition to five. Instead the company is required to distribute the vast majority of its profits 85 to its investors each year. Irish REITs will be listed on the main market of a recognised stock exchange in an EU member state and should have the effect of attracting fresh capital into the Irish property market and thus improve further the stability of.

Irish real-estate investment trusts stand to benefit from any move by the Central Bank of Ireland to restrict non-listed property funds from offering investors access to. Washington DC October 9 1997 - The real estate investment trust REIT industry today applauded the Clinton Administration and Congress for their efforts to ensure that most foreign investors can continue to invest in US. 125 corporation tax rate on active business income.

Company a REIT is exempt from corporation tax on qualifying profits from rental property. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. The main tax incentives in Ireland are.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. 20 withholding tax is. REITs are partial conduits because unlike corporations in general REITs may deduct dividends paid in determining taxable income.

Ireland Immigration by Real Estate Investment Trusts REITs The investor must make an investment of not less than 2 million in the shares of one or multiple real estate investment trusts listed on the Irish stock exchange. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. The applicant must invest in.

Conditions for REIT status. REITs offer investors the benefits of. The aim of a REIT is to provide an after-tax return for investors similar to that of direct diversification.

Ireland property rush risks repeat of crisis. A REIT is structured to provide after-tax returns to investors similar to direct. The updates in the Tax and Duty Manual 05-02-13 PDF 157 KB include the following.

Irish resident shareholders in a REIT will be liable to income tax on income distributions from the REIT plus PRSI and USC. Reits were also in. Annual Statement section 705M.

Or group of connected persons can control the REIT. The following conditions must be fulfilled by investors opting for this residency option. An Irish resident individual owning shares in an Irish REIT will be subject to Income Tax and USC on the dividends from the REIT.

A 20 withholding tax may be levied in. Stamp duty on the acquisition of Irish real estate applied at rates of up to 9 during the heady days of the Celtic Tiger but has since been reduced to 2 in respect of commercial non-residential property and 1 in respect of residential property where the consideration is up to 1 million 12 million and 2 on the balance over 1. REIT Industry Hails Tax Treaty Compromise Treasury Senate Reach Agreement on Tax Withholding for Foreign Investors.

A real estate investment trust or REIT could play a key role in helping to relieve stresses on both the Irish commercial and residential markets. These profits are then taxed at investor level. A 25 credit on qualifying R.

Income profits and capital gains of the qualifying property rental business of the REIT are exempt from corporation tax. Total effective tax deduction of 375. For the low level of applications of investors choosing the REIT investment route is a general lack of awareness of the benefits of Irish REITs as an immigration investment option.

Irish Revenue has published updated guidelines concerning the tax treatment of expenses and benefits for certain workers who are working remotely e-workers in response to the coronavirus COVID-19 pandemic. Ability to exploit IP at favourable tax rates. Fundrise just delivered its 21st consecutive positive quarter.

A REITs shareholders are taxed on dividends received from the REIT. The idea is to shift tax liabilities on to shareholders who must by law receive at least 85 per cent of a Reits. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

The company must distribute most of its rental profits to investors each year for taxation at the level of the investor. Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors. To eliminate the double layer of taxation that typically hinders the holding of property through a company a REIT is exempt from corporation tax on qualifying profits from rental property.

Distributions of income profits and capital gains by the REIT are treated as income from a property rental business in the hands of investors.

Us Dividend Withholding Tax Singapore

What Is Capital Gains Tax And When Are You Exempt Thestreet

Global Medical Reit Announces Fourth Quarter And Year End 2019 Financial Results Business Wire

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

United States Securities And Exchange Commission Washington D C 20549 Form N Csr Certified Shareholder Report Of Registered Management Investment Companies Investment Company Act File Number 811

Educated Reit Investing The Ultimate Guide To Understanding And Investing In Real Estate Investment Trusts Wiley

Reit Investing And The Active Advantage Insights Cohen Steers

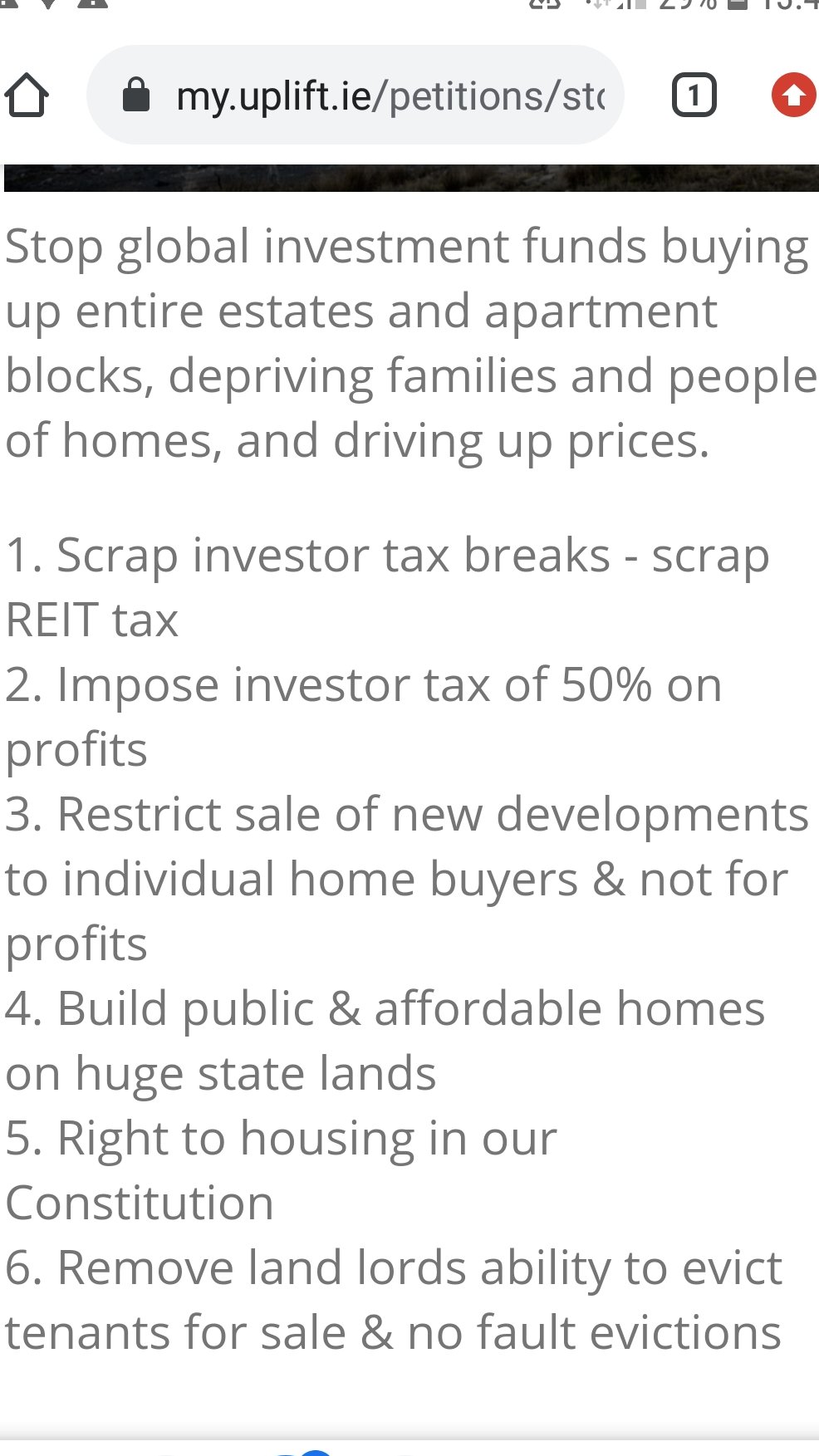

Dani Cullen Danicullen Twitter

Pwc Family Office Location Guide Pwc

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

The Benefits Of Investing In Reits Ts Financial Group

Reit Investing And The Active Advantage Insights Cohen Steers

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Does Green Reit Buyer Have Tax Back Case

What Is Capital Gains Tax And When Are You Exempt Thestreet

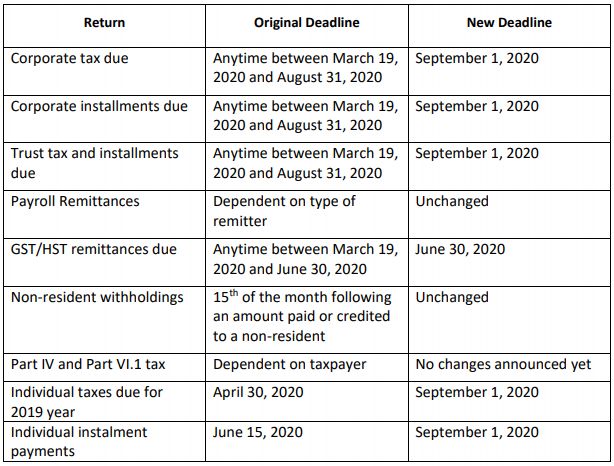

The Canadian Revenue Agency Extends Nearly All Tax Filing Deadlines Due To Covid 19 Tax Authorities Canada